Supplying Demand: The Chip Shortage in Macro Context

By Skanda Amarnath and Alex Williams

Many thanks to Hassan Khan for helping with this piece

Summary

This post is the first in a series that uses the history and economics of the American semiconductor industry to ask big picture questions about the future of fiscal policy and industrial policy. As the pandemic ends, the US will have a world-historical opportunity to revamp its public and economic infrastructure. However, to ensure that industrial policy is effective, many older strategies need to be updated to ensure that they are consistent with the suite of macroeconomic policy settings that support tight labor markets. Today’s post argues that the present shortage of semiconductor chips shows how dependent “supply-side” factors are on “demand-side” factors, and sketches a way forward for policy on that basis.

In economics, it is common to think of supply and demand as distinct, separate, and opposed forces. However, recent history shows that supply is often driven by expected and realized demand, through adjustments in investment and capacity utilization. For policymakers meeting to discuss the recent semiconductor shortages, this point is critical. The present crisis in semiconductor manufacturing has much deeper roots than pandemic-driven supply disruptions. Crafting effective policy to rectify the shortage requires us to reckon with these long-term causes, but also widens the aperture for supply-side government spending dramatically.

The Chip Shortage in Macro Context

Recently, we have seen a flurry of news about semiconductor shortages leading to production stoppages and supply shortfalls in numerous product categories. Since semiconductors play some role in nearly every part of a modern economy, the shortage has created an emerging bipartisan consensus to “Do Something.” However, to understand the effective scale and strategy of “Doing Something,” we first need to understand what the current shortage, and its attendant market dynamics, is revealing about the economy.

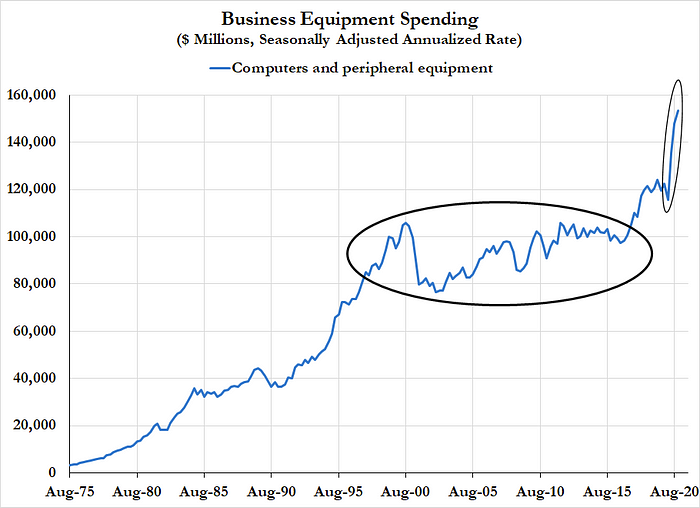

The present semiconductor shortage is best understood as both an acute and long-gestating crisis. Given present capacity constraints in shipping and widespread economic disruption from the pandemic, the current shortage is not surprising. At the same time, semiconductor manufacturing has seen a generalized decay in capital expenditure over the past twenty years. It would be easy to assume that the shortage is driven by a supply shock from disrupted global value chains against a background of constant demand. In reality, the situation is exactly the opposite: the semiconductor shortage is the product of an explosion of demand in the face of consistent supply. Despite the pandemic, demand for capital equipment that relies on semiconductors has broken out of a nearly twenty-year slumber. In short — increased demand drove increased capacity.

As we will demonstrate below, problems of demand and problems of supply are so intricately intertwined that simple “Econ 101”-style models shed little light on the current situation, and provide even less guidance towards an optimal policy response. Supply conditions — labor supply, as well as capital expenditures and rates of capacity utilization — are tightly coupled to current and expected demand conditions. At the same time, productive bottlenecks can arise from poor investment planning. Preventing future shortages will require that fiscal policy use conventional demand-side tools alongside coordinated investment in robust supply chains.

Fiscal Policy and Capital Expenditure

Throughout the 2010s, prominent economists like Larry Summers and Tyler Cowen were keen to explain the observed slowdown in real productivity growth and private fixed investment without reference to demand-side factors. Cowen’s thesis centered around a slowdown in the pace of technological advancement. Summers posited a variety of “structural” dynamics — demographics, business model shifts, inequality — that were suppressing the need or willingness of firms to increase capital spending. While structural factors may play some role, both of these arguments insufficiently recognize how deeply “demand-side” dynamics are intertwined with, and often causal to, capacity and productivity outcomes.

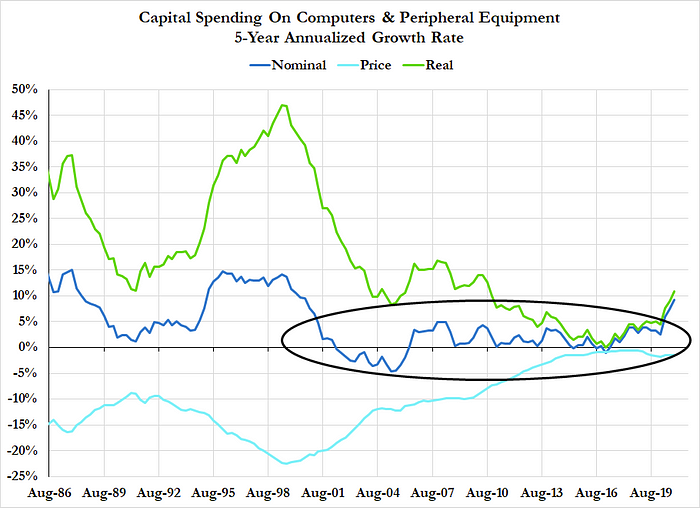

Some recent, more granular, examples from the business fixed investment data make this point more tangible. The 1990s were characterized by incredible hype about the rapid rate of technological advancement in computer hardware and software (which, it is worth remembering, took a while to show up in the productivity statistics). However, that excitement had apparently dissipated by the 2000s and 2010s, when both nominal and real spending in those same categories decelerated dramatically.

So why has spending on capital equipment broken out of its decades-long slump so rapidly? Of course, some of this surge can be attributed to the one-time need for tech equipment to support a work-from-home lifestyle. Home office demand is surely playing some role, but total spending on computers and peripheral equipment has continued to increase quarter after quarter, more persistent than a pure “one-off” dynamic. Normally recessions coincide with a propensity to “hoard.” Firms cut back on capital expenditures and hiring because aggregate demand dictates the expected timeline for sales to recover.

The real answer lies with macroeconomic policy. While the initial impulse of the pandemic led to a deeper economic shock than even the global financial crisis, the fiscal and monetary policy response to the pandemic shock was much more forceful.

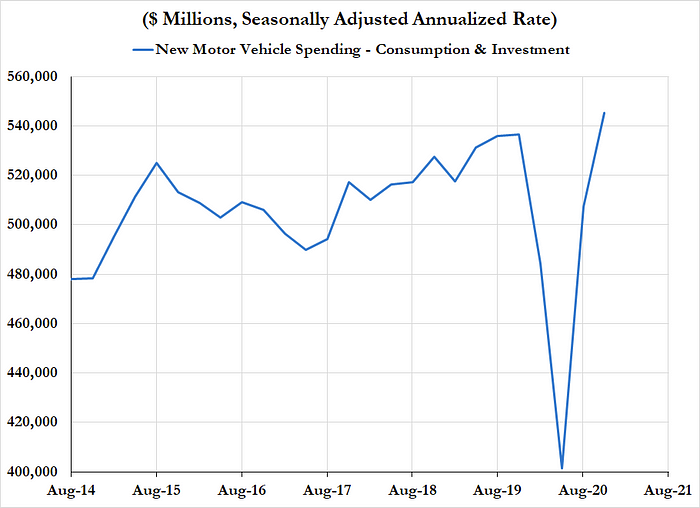

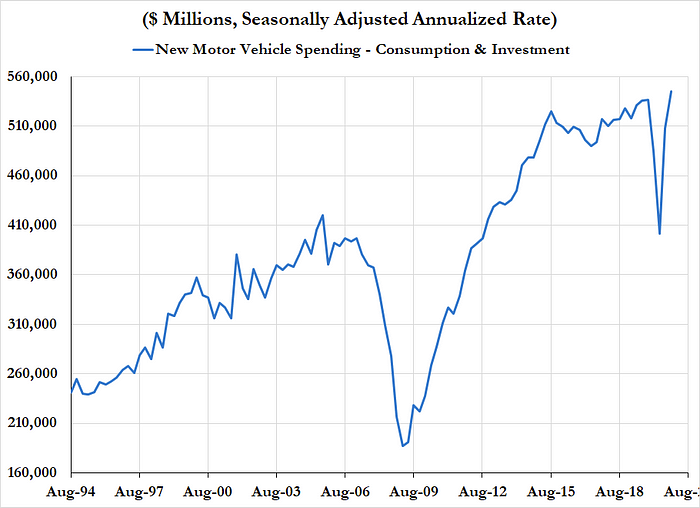

Broad-based and targeted fiscal transfers were much larger than in any previous economic downturn. At the same time, the Fed dramatically increased the speed and expanded the scope of its accommodation efforts. With such unprecedented support for private sector balance sheets, classically cyclical interest rate-sensitive sectors, like housing and autos, saw a swift rebound even as the pandemic continued to depress demand for services.

The difficulty automakers now face in procuring semiconductors, for example, owes much more to a spike in demand for automobiles than a drop in capacity for semiconductors. To learn a useful lesson from this experience, we should recognize that supply and demand aren’t opposing forces. Changes in demand can drive changes in supply, whether by pulling new capacity online or by forcing firms to depreciate and decommission existing capacity.

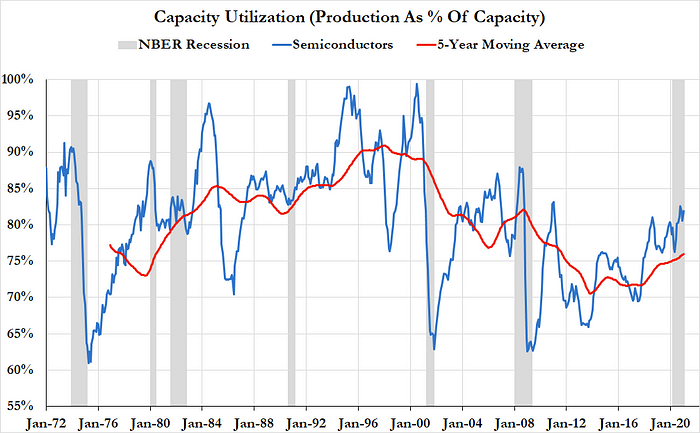

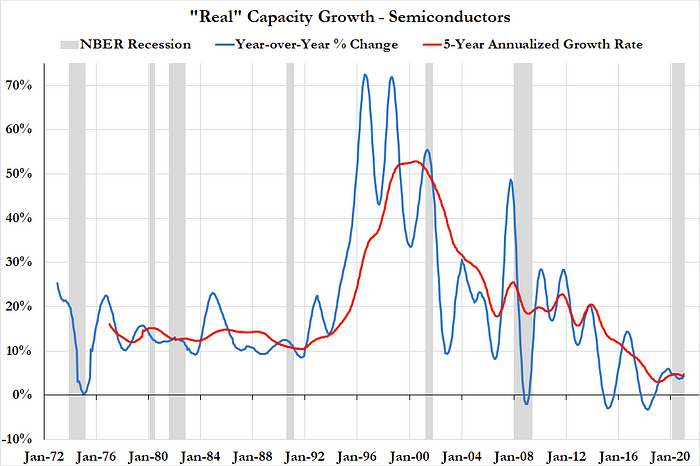

For the private sector to believe that investments to expand capacity are financially viable, demand needs to be generated effectively and consistently. The Federal Reserve’s statistics on capacity utilization reveal that semiconductor manufacturing has undergone a dramatic shift away from running at the full capacity pace that characterized most of the 1990s. The 2000s and 2010s were marked by historically slack supply chains: weak aggregate demand, offshoring, and business model shifts acted in concert to shrink production relative to existing capacity. As we can see in the chart below, this dynamic hit semiconductor manufacturing particularly hard.

Weak demand relative to current capacity is a powerful disincentive to invest in future capacity. The inverse is true as well: robust demand is a powerful incentive for investing in future capacity. To get a sense of the relevant timescale for evaluating demand conditions, it’s worth remembering that investments in semiconductor manufacturing take the better half of a decade to pay off. For firms to sacrifice liquidity and free cash flow for capacity-expanding capital expenditures, they must be confident that demand for that capacity will materialize.

While interest rates fell substantially over this period, in many cases it isn’t possible to bring interest rates low enough to incentivize investment in a chronically low aggregate demand environment. However, the fiscal response to the pandemic has done what years of near-zero interest rates failed to accomplish: investment in capital goods that disproportionately rely on semiconductor and other high-tech manufacturing is actually rising. While the possibilities and relevance of monetary policy will be addressed more specifically in later pieces in this series, the lessons for fiscal policy are worth dwelling on.

The best lesson to learn from these pandemic-driven policies is that seemingly intractable supply-side trends can, in fact, be resolved using demand-side macroeconomic policy. Policy cannot productively treat shortages and supply-side problems without addressing the demand-side problems that produce and sustain them.

Capacity, Supply and the Labor Market

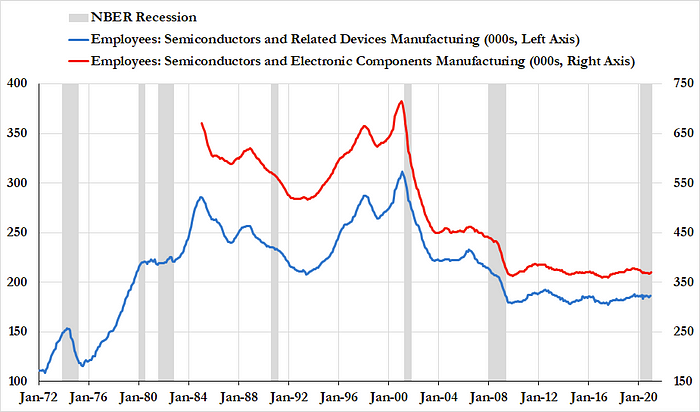

In light of persistently underutilized capacity and underinvestment, it should come as no surprise that the labor market trends within semiconductor manufacturing show the same consistent weaknesses. Employment, like capital investment, peaked with the tech boom and never really recovered from the ensuing recession that “officially” began in 2001.

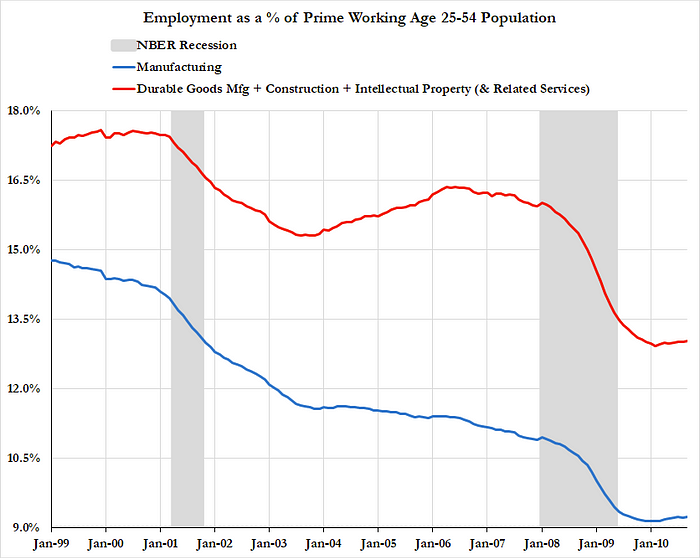

In the US, this problem extends beyond the semiconductor industry. After the “official” end of the 2001 recession, US manufacturing as a whole endured not just a jobless recovery, but a decade-long jobless expansion. While a short-lived boom in residential construction is visible in the data below, it wasn’t as if we merely traded in jobs producing capital goods for jobs involved in the production of intellectual property. The stall out in semiconductor manufacturing discussed above was part of a broader trend that ensured that the growth of “new economy” jobs paled in comparison to the number of manufacturing jobs lost following the 2001 recession.

While it might be convenient to say that this is actually an intentional outcome from trade policy — the argument being that many subsets of manufacturing are low value-add and thus best imported— it is not obvious why this would be the case for semiconductors. As former Intel CEO Andy Grove noted in an interview:

Without overly romanticizing past manufacturing-based economies, it is critical to recognize that the semiconductor industry, and manufacturing as a whole, require and create highly technical skillsets in labor and deep institutional knowledge in supply chains. In recent years, Taiwan Semiconductor Manufacturing Corporation has managed to build just this kind of skill and knowledge into a key strategic advantage in global markets. The insufficient demand that limits investment in future capacity also limits present employment and the development of robust supply chains. In fact, the failure to ensure sufficient capacity expansion in semiconductors that we are seeing as a shortage in today’s supply chains was originally felt as persistent job loss in that sector, and in manufacturing as a whole.

Persistently low demand and slow growth in employment reinforce one another, and together shape firms’ decisions to invest in capacity, creating the supply-side problems we see in the present semiconductor shortage. Underinvestment and underemployment are not problems that solve themselves. Instead, long-term management of supply is predicated on ensuring sufficient short-term demand for firms to hire and invest in new capacity. While it may have been excusable to miss this point during a decade-long expansion, the pandemic experience provides clear evidence that demand-side fiscal policy can have substantial impacts on investment and capital expenditure.

Bringing It All Together: The Role of Policy

Our lawmakers should strategize about the current shortage of semiconductors in full recognition of the fact that increased spending and coordination between the public and private sector can lead to increased output, a stronger economy, and better investment and employment outcomes across the board. However, doing so requires a broader vision of what counts as a public good. In a way, supply chains themselves are infrastructure. Decades of offshoring and development of just-in-time supply chains have enhanced profitability for individual firms at the expense of the robustness and legibility of the system as a whole. Fiscal policy has a potentially massive scope to ensure that investment is systemically coherent, and demand is managed for the benefit of firms and workers alike.

Thinking purely in terms of “supply and demand” as opposing forces is unlikely to produce good policy. Separating macroeconomic shocks using a purely ex-post classification system of price and quantity outcomes may make sense, but even those ex-post classifications don’t always fit neatly with our intuitions. While pandemic-induced shutdowns might be intuitively associated with a negative shock to “supply,” inflation readings fell alongside the decline in output and thus would be more coherently classified (ex-post) as a “demand shock.” Choosing incorrectly in real time can have serious policy implications. Under the assumption that the pandemic was primarily a “supply shock,” Ken Rogoff and other prominent economists suggested that the policy response of monetary and fiscal easing would be highly inflationary. Had lawmakers and policymakers agreed with such thinking, they might not have acted as aggressively as they did.

So far we have seen that demand conditions have substantial influence on long-term supply conditions and that fiscal policy has produced demand conditions that pulled capital investment in semiconductors out of a decades-long slump. Now that policymakers are meeting to discuss the semiconductor industry, it behooves us to pull these threads together, and ensure that policy solves the real problems our economy faces.

To take an example from the problem at hand, automakers are facing a particularly acute shortage because many of the semiconductor chips they need are far from the technical frontier. Per Anjani Trivedi at Bloomberg, there is:

This is exactly the kind of capital formation that the public sector could take on if there were a more capacious view of economic infrastructure. Investments in this space are costly and front-loaded, while the payoffs are often marginal, uncertain, and heavily back-loaded. Consolidation in the semiconductor industry in particular has led to a situation where new applications that don’t need the newest chipsets — think autos — have no ecosystem of producers to supply their needs. Capital expenditure by most semiconductor firms is heavily concentrated on the newest nodes and most recent processes, offering little capacity for new uses of older tech. Ensuring supply-chain-wide capacity is often ignored in favor of narrow “science policy” that concentrates solely on National Science Foundation grants to advance the bleeding edge of the technological frontier. At the same time, poor management of aggregate demand and employment ensures that capacity at the trailing edge steadily dwindles.

In the absence of such capital formation, automakers, US-based semiconductor design firms, and a wide variety of manufacturing concerns are at the mercy of monopolistic chokepoints, dealing with supply bottlenecks, selling fewer units, and reducing hiring. Manufacturing capacity hardly fits the neoclassical definition of a public good: it is neither “nonrivalrous” nor “non-excludable.” However, it is in keeping with an older, homegrown “common carrier” conception of what qualifies as infrastructure. The public sector also has a uniquely flexible balance sheet that should allow it to step in and facilitate the formation of assets that are unlikely to profit a private investor, but which provide a collective benefit to businesses, and to the economy at large.

Beyond the low-tech problems automakers are facing, production capabilities at the technological frontier have also dwindled. Intel, once a domestic champion in cutting-edge semiconductor production, has fallen further behind Taiwan Semiconductor in the technological pecking order. The US policy approach of focusing production and innovation in single domestic firms like Boeing, Intel and GE has created fragile champions with supply chains tailored to their particular, narrow approach. Without an ecosystem of robust supply chains, if any of these companies lose their footing, the US as a whole loses its footing in these industries.

While Taiwan Semiconductor will be building a plant in Arizona in the near future, one facility is a drop in the bucket relative to what the government could be catalyzing right now. Governments can provide certainty not just through regulation, but through deploying its balance sheet to guarantee sufficiently smooth demand in areas with substantial productive and technological benefits but which tend to be subject to highly uncertain manufacturing yields and inventory levels. While the elasticity of the government’s balance sheet can be a powerful tool for overcoming private sector hurdle rates in pursuit of public benefit the government can do even more by helping coordinate investment to ensure coherent supply chains.

If this all sounds like a return to “Industrial Policy,” that’s because it is. To the extent that the U.S. wants to remain at the productive and technological frontier, scaling up these types of efforts will also raise the quantity and quality of labor market opportunities, across the occupational spectrum. Supply and demand are so intertwined that the public sector can serve as the ideal problem solver for a wide array of collective action problems. At the same time, fiscal policy can help ensure aggregate demand remains at a level consistent with increasing, rather than decreasing capacity. The scope for government action to complement a productive and innovative private sector is much wider than what is traditionally considered “the supply side.” Prudent policy focused on resolving the semiconductor shortage and ensuring long-term growth requires a broad-based view of infrastructure, and an even wider conception of what factors determine the supply side.

¹Figure 7 Footnote: The real rate of investment has slowed over the years, but this is also the byproduct of the price index deflating more slowly due to Moore’s law slowing down (see Figure 2). There has been a concerted effort to incorporate improved semiconductor quality and performance into the real national accounts data that began in the 1980s and 1990s:

We have to be careful about what we mean when we discuss strong investment and productivity in this space. Is this about producers of such equipment earning more revenue or consumers getting higher quality versions of the same units? From the perspective of the producer, sales are still the important bottom line for evaluating the performance of past investments and the viability of future investments.